How can we help you?

How can we help you?

How can we help you?

Journey

Future

Retirement

Accessibility Tools

Independent, fee-based fiduciary advisors specializing in retirement planning, tax strategies, charitable gifting, and multi-generational wealth management. Our collaborative team, including CFP® Professionals and in-house tax professionals, helps individuals, families, and employers design their best retirement.

We work with employers to help provide customized retirement plan solutions for their employees.

Providing answers to design your best retirement

Subscribe for Weekly financial insights.

Years in business

(Founded in 1976).

Clients by household.

Employees across

two locations.

Assets under management

(in millions).

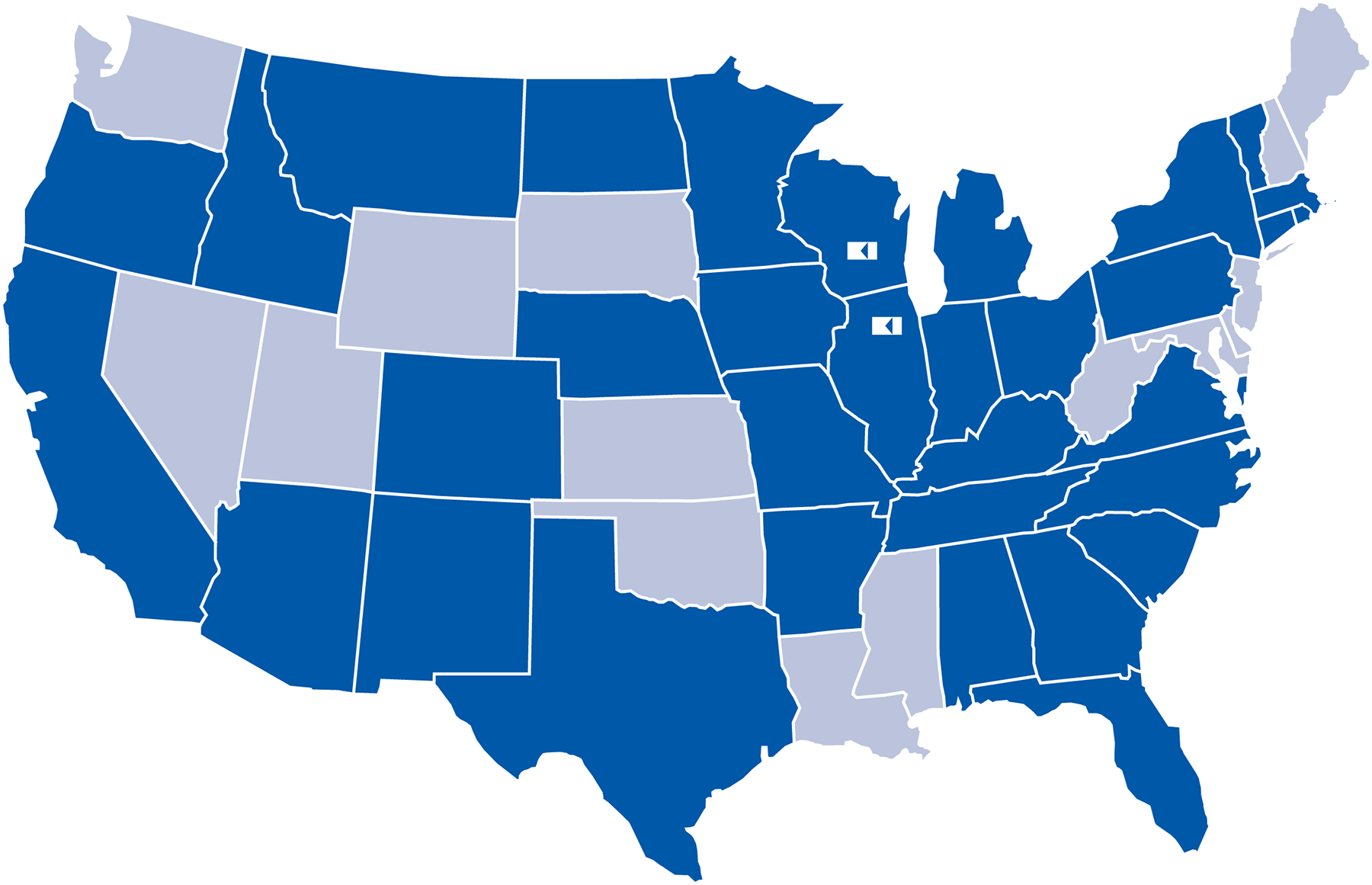

States where clients

are served.

This total represents approximately $755 million in client assets under management through our discretionary asset management wrap fee program (Klaas Investment Portfolios – KIP), approximately $6 million in retirement plan assets through our Klaas 401K Retirement Plan Services discretionary 3(38) offering, approximately $28 million in assets under advisement through our Klaas 401K Retirement Plan Services non-discretionary 3(21) offering, and approximately $28 million in assets under advisement through our non-discretionary Klaas Investment Consulting Services for brokerage customers. All "By the Numbers" data is as of January 2nd, 2026. **We proudly serve clients in 32 states with two offices located in Wisconsin and Illinois.