With our in-house tax services, Klaas clients may choose to have their federal and state individual income tax returns prepared by our tax professional. This service is only offered to Klaas clients—though it is not obligatory. Klaas clients can choose any firm they like to prepare their tax returns.

HISTORY

Klaas Financial launched income tax preparation services beginning with 2024 tax returns.

SYNERGY

Tax preparation leads directly into financial planning. Benefit from seamless coordination and communication between your financial planner and tax preparer.

CONVENIENCE

Simplify your schedule by working with just one firm for your accounting and financial services. Save time by delegating your tax preparation to Klaas.

EXPERIENCE

Our tax specialist is an IRS-enrolled tax professional with years of experience, and they work closely with your financial adviser to optimize your tax strategy, especially for retirement goals.

COST

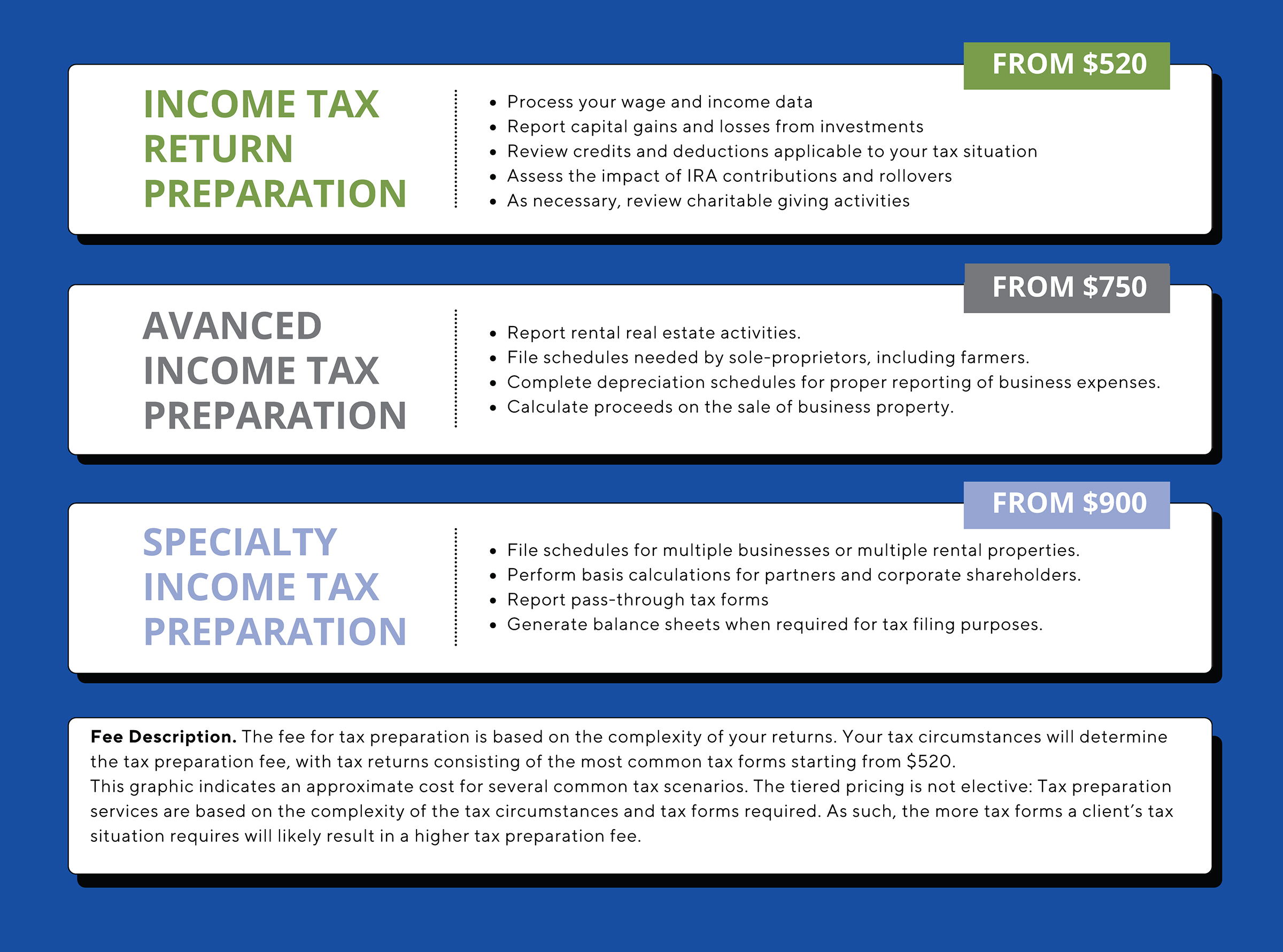

The fee for tax preparation is based on the complexity of your returns (i.e. the number and type of required forms and schedules and other circumstances). Some forms that are billed hourly are also subject to minimum fees.

I know I want Klaas to prepare my taxes, what do I do next?

If you want to move forward, please let us know now. With one staff member preparing tax returns, we have a finite capacity for the number of returns we can process in our first year. Please contact us at 815-877-8440 or add your name to the queue by completing this one-question survey.

We also have a resource center on our website that can provide videos and articles about a wide variety of financial topics and our Klaas Koffee Chats.

Additional Income Tax Resources:

2025 Tax Brackets

2024 Tax Brackets