Dear Valued Client,

Since our last update, global markets have continued to slump due to coronavirus-induced economic fears. We know this has been a difficult environment, understandably the past few weeks have been worrisome for all of us.

What’s Been Happening…

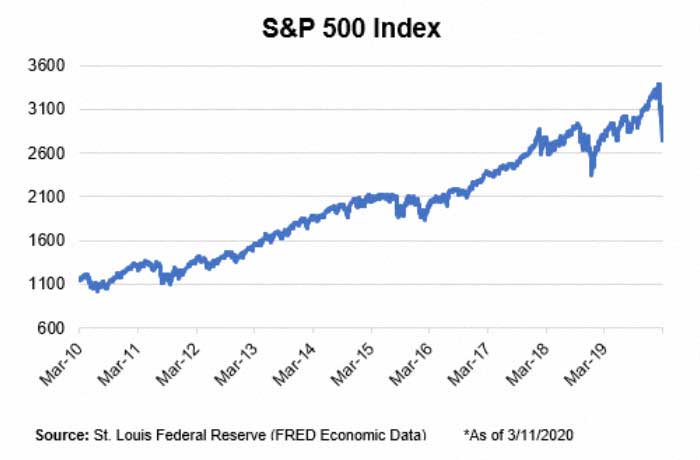

Coming out of the 2008 financial crisis, in March 2009 the S&P 500 Index hit rock bottom roughly 11 years ago today. Since then, the past decade brought about a momentous climb, mostly uninterrupted and without experiencing an offsetting “bear market” (signified by a 20% drop) until recently.

The tumultuous moves in financial markets are in response to concerns and eroding confidence for investors and households from the coronavirus. In the early days of the disease, the coronavirus had been viewed largely as something that was happening “over there,” and its effects seemed second-hand and far-removed:

- Slowdown of the Chinese economy from factory closures

- Curtailment of travel to and from Asia

- The adverse impact of shutting down critical parts of the world supply chain

Fast forward to present, the difficulties and cautions emanating from the coronavirus have been felt closer to home. In the US, both the real economy and the financial economy are exhibiting signs of strain.

Travel is drying up: Airlines, hotels, cruises, and casinos have experienced slumping demand and cancellations. Employees are being furloughed. Many US companies and corporations have curbed overseas travel or domestic travel, industry conferences have been cancelled, and mass gatherings such as sporting events have been postponed or discouraged.

While the virus fear and uncertainty might be temporary and short-lived (e.g., we may not be talking about this 2-3 years from now), there is genuine risk and concern near-term if the coronavirus epidemic extends through the spring and summer. If people are shut in at home and unable or unwilling to go to work, shop, eat out, or travel as usual, how negative will the impact be to the broader economy?

The textbook definition of a “recession” is a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP output (Gross Domestic Product) in two back-to-back quarters.

Putting It In Perspective

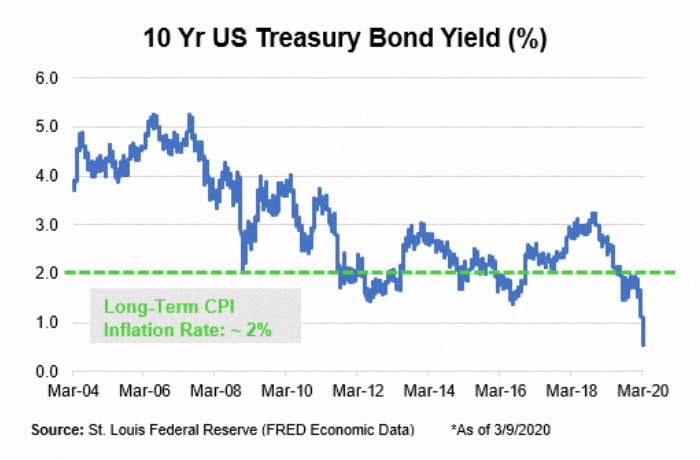

This past month, bond yields have been falling in tandem with the sharp drop in stock markets. Prices and returns of bonds as compared to stocks often behave and move opposite from one another. Thus, the recent drop in bond yields have boosted returns for such safe haven assets (bond prices increase when yield level decreases).

Times like these remind us of the nature of equity markets and why they have outpaced both bonds and inflation over longer time horizons. They also remind us of the importance of diversification and discipline. Unless your financial circumstances have changed, we believe this is not a time to take unusual actions related to your portfolio. Rather, it’s a storm that should be weathered by the long-term investor.

Your investment portfolio and long-term plan is thoughtfully designed, and incorporates diversification across many types of assets, including bonds and fixed-income – which are held as a buffer for stability. Stocks generally entail more risk and seek to provide long-term capital growth and higher returns than bonds and inflation.

Lessons from the Past

Human emotions are among the root causes for the extreme swings in financial markets over time. Big drops and big headlines challenge our resolve to stay the course, and stay objective in our decisions. So often, fear or emotions trigger us to do the wrong thing at the wrong time.

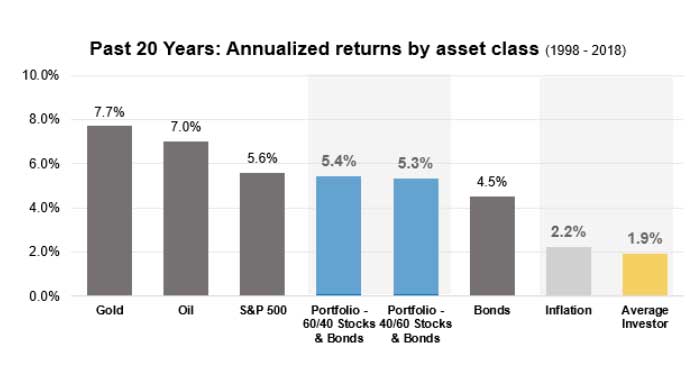

The negative impact and outcomes of frenetically jumping from one investment to the next is illustrated in the graph below. Over the course of time, individual and institutional investors have tended to sell fund investments underperforming over shorter time periods, and buy the most recent best performing funds and investment asset classes. Here’s the problem: the hotel of top performance is always fully booked, but the guests are always changing.

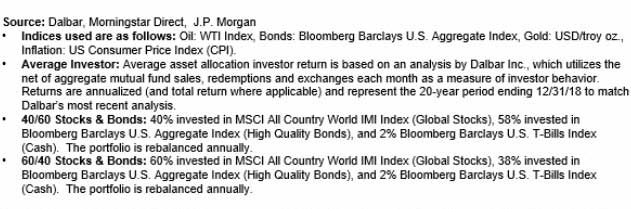

Research consultancy Dalbar Inc. has tracked this activity and behavior over the course of time to estimate an “average investor” return. The analysis above shows the adverse impact on investor outcomes that can happen from emotional and impulsive decisions to buy and sell.

Those who sell in a market storm rarely notice when the storm clouds begin to lift. And, as investors, missing those stock market rebounds is perhaps the biggest risk to achieving our long-term goals.

Cannot Predict. Can Prepare.

We will get through this. We foundationally believe that planning, patience, and discipline will be rewarded. Our thoughtful financial planning and structured investing process at Klaas Financial aims to ensure the best possible outcomes toward your financial well-being and retirement.

If you do have any questions or concerns that you would like to discuss, please do not hesitate to reach out and get in touch with your advisor. Let’s talk through it together.

We are grateful for the continued trust and confidence you have placed in our team and organization to help you plan and invest for your future. Please stay healthy and don’t hesitate to get in touch if you have any questions or concerns.

Definitions & Disclosures

- S&P 500 Index is a market capitalization stock index that measures the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices of the U.S. stock market.

- MSCI All Country World IMI Index is a market capitalization weighted index designed to provide a broad measure of equity-market performance throughout the world in both developed and emerging market countries. The index covers over 3,000 constituent holdings and is designed to represent performance of the full opportunity set of large- and mid-cap stocks across 23 developed and 26 emerging markets countries.

- Bloomberg Barclays US Aggregate Index, or the Agg, is a broad base, market capitalization-weighted bond market index representing intermediate term investment grade bonds traded in the United States. Investors frequently use the index as a stand-in for measuring the performance of the US bond market.

- Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them.

- WTI Index — West Texas Intermediate (WTI) crude oil — is a specific grade of crude oil and one of the main three benchmarks in oil pricing.