Last Week’s Question of the Week: Due to severe weather conditions, we did not pose a question during last week’s show.

ANSWER: N/A.

HOST: Today we’ll talk a lot about income taxes. Can you offer some simple tax preparation tips for this year, and also, how listeners can simplify their taxes for next year?

KLAAS FINANCIAL: We know that everyone begins to get anxious this time of the year, either you are looking to get a refund ASAP, or you’re just putting off doing your taxes because you know you will be paying out more money. Hopefully, we can help everyone today.

DISCLAIMER: We always want to remind our listeners that, first and foremost, we are not accountants. For your own specific tax advice, you should seek the services of a tax professional. However, we do work with several tax accountants and over the years we have learned about some good practices that we can share to help our clients.

So, the tax season officially kicked off on Monday, January 28, 2019, and the Internal Revenue Service (IRS) expects to process more than 150 million individual tax returns for the 2018 tax year. According to the agency, “through mid-day Monday, the IRS had already received several million tax returns during the busy opening hours.”

Despite a lapse in funding and a reduced workforce due to the 35-day government shutdown, the IRS has begun accepting tax returns and will provide refunds to taxpayers as scheduled. Employers sending out W-2s must file and postmark tax-related documents by January 31, so you should receive your forms by early February. But if you receive all your forms before then, you can file your tax return as soon as you’d like.

In order to submit your tax return, you first need a W-2 form, or Wage and Tax statement, from every employer you had during 2018. If you’re a freelancer, you’ll need 1099 forms. REMINDER: the deadline for filing your 2018 tax returns is Monday, April 15, 2019.

HOST: What are some tips for doing our tax prep this year, and how can we simplify our taxes for next year?

KLAAS FINANCIAL: Create a 2018 tax file to secure all of the W-2s, 1099s and other statements when they show up. At the same time, you can create a tax file for 2019 to improve your preparation for next year.

The most common 1099s are 1099-Div, and 1099-R (Distributions from pensions, annuities, retirement plans, IRA’s or Insurance Contracts) Other 1099s are for independent contractor income, Social security income, government payments etc. Remember a lot of these statements may not come in the mail any longer, because more and more people have them available online. You can download them as soon as they become available.

Make a list of what documents you actually need to prepare your taxes. What are the deadlines that you can expect statements? Jan 31st for the IRAs, Feb. 15th, March 15th etc. Figure out who will be doing your taxes. Are you going to prepare your own taxes with tax software, or hire a tax preparer, CPA etc.? Is this the year to make a change? Schedule your tax consultation sooner than later.

Sometimes people worry so much about saving money on not hiring others to help with taxes, when often times they miss out on deductions that would have saved them even more money. Consider still contributing to your Traditional IRA or Roth IRA before you file (you have up to April 15th to contribute). Remember up to $5,500 per person under 50 with earned income, $6,500 for over 50, or non-working spouses. It is too late to add money to your 401k from last year.

HOST: Does everyone have to file a tax return?

KLAAS FINANCIAL: There are situations where you don’t need to file. The IRS considers your age, your filing status and your income. If you didn’t have any income probably not, but it would be worth discussing with your tax preparer just to be sure. You don’t want to leave potential losses that you experienced on the table, that could be carried forward to another year.

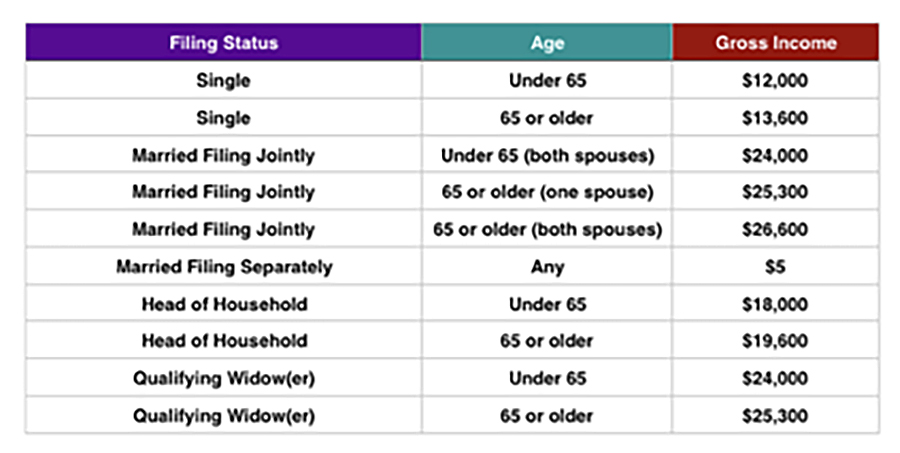

In 2019, for most taxpayers, if your gross income is above a particular threshold, then you will have to file. For example, if you are filing single over age 65, income needs to be above $13,600; married filing jointly with both over 65, if your joint income is OVER $24,000 then you need to file. One surprising thing to note is that if you are married filing separately of any age, and your gross income was $5, yes $5, then you must file a tax return. Here’s a breakdown:

HOST: What are some of the key changes in our taxes that we will see when we file this year with last years new tax bill?

KLAAS FINANCIAL: Here are a few things to be aware of.

- Increased standard deduction: The new tax law for 2018 nearly doubles the standard deduction amount. Single taxpayers will see their standard deductions jump from $6,350 for 2017 taxes to $12,000 for 2018 taxes (the ones you file in 2019). Married couples filing jointly see an increase from $12,700 to $24,000. These increases mean that fewer people will have to itemize. Today, roughly 30% of taxpayers itemize. Under the new law, this percentage is expected to decrease.

- Increased Child Tax Credit: For, families with children the Child Tax Credit is doubled from $1,000 per child to $2,000. In addition, the amount that is refundable grows from $1,100 to $1,400.

- Personal and dependent exemptions: The bill eliminates the personal and dependent exemptions which were $4,050 for 2017 and increased to $4,150 in 2018.

- State and local taxes/Home mortgages: The bill limits the amount of state and local property, income, and sales taxes that can be deducted to $10,000. In the past, these taxes have generally been fully tax deductible.

HOST: What if I want to use tax software like TurboTax, how will I know what forms to use?

KLAAS FINANCIAL: Your tax software will ask for specific forms. If you receive an unexpected form after you have filed, then you will have to amend your return which will cost money if you have an accountant doing this. It is best to ensure that all your information is accurate and complete before you file your taxes.

If you received income other than that from your employer over the last taxable year, then you will need to file a 1099 form. There are several different kinds of 1099 forms and they will be labeled differently. For example, if you worked as an independent contractor and earned more than $600 last year in rent or compensation, you will need to file a 1099. Concurrently, if you earned dividends and/or distributions from your stock portfolio last year, a 1099 (albeit a different type) will also be required.

You will also need a 1099 if you received government payouts (like unemployment), made a withdrawal from a taxable retirement account, or if you had a debt cancellation.

1098 Forms for Interest Deductions: If you plan on claiming a deduction because of your mortgage interest, you will need form 1098 from your mortgage company. You can also student loan interest that you paid over the year. The company will issue you a 1098-E form.

HOST: What if I got divorced this year, or maybe even lost my spouse? Is there something different I need to do when I file my taxes?

KLAAS FINANCIAL: Yes, changes in your filing status are important. If you got married, divorced or lost a loved one, your tax filing status has changed. Did you have a child (tax deduction) or maybe one of your children is now out on their own? Can you still deduct for them? Remember, this will affect their tax forms as well. In any of these cases, it is a good idea to schedule an appointment with your accountant now for a future date when you think you will have all of your documents.

HOST: What if I need to file an extension for my taxes, what should I know?

KLAAS FINANCIAL: Sometimes your taxes are more complex than you expect. Be ready for an extension, if necessary.

If you are unable to complete your 2018 federal tax return by the April deadline (April 15 in 2019), you’ll first need to file an extension with the IRS to avoid any potential late-filing or late payment penalties. Filing an extension will allow you to push your deadline back six months to October 15, 2019.

It’s important to keep in mind an extension only pushes back the due date to file your tax documents. An extension does not give you extra time to pay on any taxes you may owe. If you believe you will owe money this year, you’ll need to estimate the amount after filing for an extension and make a payment by the April deadline.

HOST: What are some other things I can do to enhance my tax planning today?

KLAAS FINANCIAL: Simplify, Consolidating and Diversifying. One idea is to reduce the number of your accounts. We call this account clutter. If you have multiple accounts with the same titling, several IRA’s and old 401ks you should consider consolidating these accounts. Doing so will make it easier to see your true overall asset allocation mix. With fewer accounts you can keep track of websites, passwords and keep beneficiary designations up to date. After-tax accounts have to be looked at more carefully before combining, but perhaps taking a loss, or taking a gain may make sense for you this year.

Another area to eradicate is credit clutter. Do you really need all those credit cards accounts? Do you have multiple loans such as student loans, car loans, etc.? Fewer accounts will protect yourself from possible identity theft.

Catch C.J. Klaas and Maleeah Cuevas on Money in Motion every Thursday on Madison's 1310 WIBA from 8:05-8:35am.